If your money has been seized by police in the UAE, it’s not automatically lost, but it enters a strict legal process that can lead to permanent confiscation depending on the case. In most situations, seized money is frozen during investigation and, if proven to be connected to a crime, is forfeited to the UAE state treasury following a court judgment.

Key Takeaways:

- Money is only permanently confiscated after a court ruling, usually following a criminal conviction.

- The UAE enforces asset seizure laws through the police, public prosecution, courts, and financial regulators.

- Innocent parties can apply for asset return if they prove legal ownership and lack of wrongdoing.

- Unclaimed or lost property may end up in the state treasury after a legally defined waiting period.

Let’s walk through exactly how this works in the UAE.

Why Do UAE Police Seize Money and Assets?

Police in the UAE are authorised to seize money or assets during an investigation if they believe those assets are either the proceeds of a crime or tools used in committing one.

This includes cases related to financial crimes, such as money laundering, terrorism financing, fraud, bribery, cybercrime, and drug trafficking.

When an investigation begins, authorities move quickly to prevent the movement, hiding, or use of criminally linked funds. The idea is simple: no individual should benefit from illegal gains.

If money is suspected to be connected to unlawful conduct, it can be seized temporarily. Later, if guilt is established through the legal process, the court may permanently confiscate those funds.

In practice, this process protects the financial system and ensures that justice prevails. It also serves as a deterrent for anyone considering using the UAE for illegal financial activity. Confiscated assets are often used to compensate victims and are transferred to the state treasury upon final judgment.

What Is the Legal Process for Seized Money in the UAE?

If your money has been seized, it enters a clearly defined legal process governed by federal laws, financial regulations, and court procedures. Each stage involves specific authorities and requirements.

Authorities Involved: Police, Public Prosecution, Courts, FIUs

Several entities are responsible for handling money seizure cases:

- Police conduct initial investigations and gather evidence.

- Public Prosecution initiates formal charges and seeks court orders for seizure.

- Courts determine whether money should be permanently confiscated.

- Financial Intelligence Units (FIUs) work with the Central Bank to trace suspicious financial activity and ensure compliance with anti-money laundering (AML) laws.

Coordination between these agencies is essential. They share intelligence, enforce seizure orders, and ensure that due process is followed.

Freezing of Assets During Investigation

During the investigation phase, police and public prosecutors can order a temporary freeze of bank accounts, cash, or other assets suspected of being connected to a crime.

These funds are frozen to prevent them from being withdrawn, transferred, or laundered. In some cases, the assets are physically seized and placed under custody, often in secure accounts or government facilities.

The freeze remains until a court decision is made or the investigation concludes. If no wrongdoing is found, the assets may be returned.

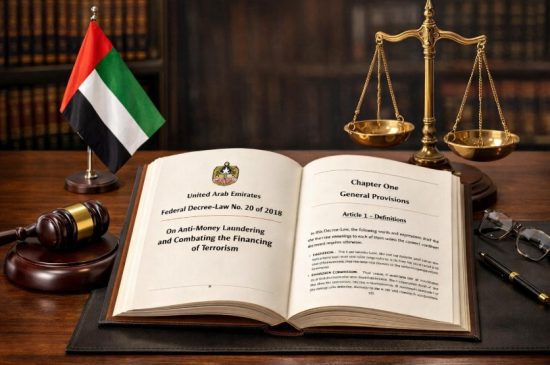

Requirement for a Court Order for Permanent Confiscation

Permanent confiscation of seized money cannot happen without a final court ruling.

Article 26 of the Federal Decree-Law No. 20 of 2018 clearly states that only the courts can order confiscation, and only when the money is proven to be:

- Proceeds of a crime,

- Used in committing a crime, or

- Equivalent in value to criminal assets that cannot be physically seized.

A conviction is generally required for this to occur. However, in some cases, the court can impose equivalent monetary fines if the original assets were transferred to third parties or are no longer traceable.

Role of the Central Bank and goAML Reporting

The UAE Central Bank plays a critical role in detecting and reporting suspicious financial activity. Through its goAML platform, banks and financial institutions are required to submit Suspicious Transaction Reports (STRs).

These reports are reviewed by the FIU, which may escalate the case to public prosecutors. The Central Bank also ensures that financial institutions follow due diligence and KYC (Know Your Customer) protocols. This regulatory oversight strengthens the system against abuse and allows swift action when unlawful activity is suspected.

What Happens After a Conviction?

Once a conviction is secured, the court issues a formal judgment ordering the confiscation of all money and assets proven to be connected to the crime. This includes both direct proceeds (e.g., drug money) and instrumentalities (e.g., a car used to transport illicit funds).

The seized funds are then legally transferred to the UAE treasury. However, before that, any claims from victims or third parties acting in good faith are considered. If approved by the court, compensation is made from the seized money, and the remainder goes to the state.

Timeline from Seizure to Confiscation

| Stage | Authority Involved | Action Taken | Typical Timeline |

| Investigation | Police, Public Prosecution | Funds frozen or seized | Immediate (upon suspicion) |

| Legal proceedings | Court | Case is heard, evidence is evaluated | Varies (weeks to months) |

| Final conviction | Court | Confiscation order issued | After legal judgment |

| Asset transfer & compensation | Court, Treasury | Funds paid to victims (if applicable) | After conviction |

| Transfer to UAE Treasury | Ministry of Finance | Remaining amount moved to state treasury | Within final execution |

This structured process ensures that confiscation only happens following legal standards.

What If You’re Found Innocent or the Case Is Dropped?

If you are not convicted, or the charges against you are dropped, you have the legal right to request the return of any money or assets that were seized. UAE law upholds the principle that innocent individuals must not suffer unjust financial loss.

You must submit a petition to the competent court with evidence that:

- You lawfully own the seized property

- You were not involved in the crime under investigation

- The assets were not used to commit the crime

Legal Options Include:

- Filing a formal petition for restitution

- Presenting ownership documents (bank statements, purchase receipts)

- Working with a lawyer to prove absence of criminal connection

- Arguing the “innocent owner” defense if the funds belong to you but were used by someone else

Once accepted, the court may order the full return of your property or funds. However, you carry the burden of proof, and this process can take time.

Can You Lose Money Even Without a Conviction?

Yes, in some cases, individuals can lose money even without being convicted. This usually happens under civil asset forfeiture laws or through court-imposed fines.

The UAE follows global standards in differentiating between criminal and civil asset forfeiture, particularly in money laundering or suspicious financial activity cases.

Civil vs. Criminal Asset Forfeiture in the UAE

- Criminal forfeiture: Requires a conviction. The court must prove the funds are linked to a crime before ordering confiscation.

- Civil or administrative forfeiture: Does not require a conviction. If the property is believed to be linked to illicit activity, the government can confiscate it through a separate civil proceeding.

- Applies to suspicious activity: Including unexplained wealth accumulation and transactions that lack a lawful source.

- Targets frozen accounts: Frequently used when bank accounts are frozen due to AML concerns or regulatory violations.

The burden of proof in civil cases is lower, but authorities still need substantial evidence of a connection to criminal activity.

Seizure Based on Suspicious Activity or Unexplained Wealth

The UAE’s Central Bank, FIU, and law enforcement monitor financial transactions closely. If large sums of money appear in a person’s account without a clear origin or documentation, it may be considered unexplained wealth.

In such situations, the money can be:

- Frozen indefinitely pending investigation

- Confiscated through civil forfeiture if deemed suspicious

- Trigger further audits or inspections

Even if you’re not charged with a crime, failure to prove the lawful origin of funds can lead to permanent loss.

Imposing Fines When Direct Confiscation Isn’t Possible

If the original assets cannot be found, for instance, if they were transferred to a third party acting in good faith, courts can impose a fine equal to the value of those assets. This ensures that criminals cannot escape consequences by hiding or disposing of illegal funds.

The fine acts as a substitute for actual confiscation and is enforceable through court orders. Ultimately, even without a conviction, you can lose your money if you cannot prove its lawful source or if it was used in an illegal transaction.

What Happens to Lost or Unclaimed Money in Dubai?

Not all money seized by authorities is connected to a crime. Some of it falls under the category of lost or unclaimed property. For example, if someone loses a wallet containing cash or if abandoned funds are found with no clear ownership, these are handled differently from criminal assets.

In Dubai, the rules are clear:

- If no owner comes forward within a year, the funds or the proceeds from their sale are transferred to the public treasury.

- However, if the rightful owner is later identified, they can still claim their money for up to 15 years after the initial seizure.

Important Points:

- The process starts when money is found and reported.

- If criminal links are ruled out, it’s treated as lost property.

- The money is safeguarded until legal timelines expire.

- Owners must provide proof to claim it, such as identification, transaction history, or witnesses.

This process ensures that even lost or abandoned funds are handled transparently and lawfully in the UAE.

How to Get Seized Money Back in the UAE?

If your money was seized and you believe it was wrongfully taken or you were later cleared of charges, you have the right to recover it through a legal process.

The request typically begins after a judgment of acquittal or case dismissal. However, even during the investigation, your lawyer can petition for its return if you’re not under direct suspicion.

Steps to Follow:

- Submit a restitution petition to the court

- Attach proof of ownership (bank statements, salary slips, receipts)

- Work with a UAE-licensed attorney to ensure due process

- Argue the lack of a criminal connection with supporting documents

The court will assess whether the funds were legally obtained, and whether you acted in good faith. If convinced, the court will order a full or partial return of the funds. This process requires patience and strong documentation.

What Rights and Protections Do You Have If Your Funds Are Seized?

When authorities seize money in the UAE, they must follow procedures that protect your legal and constitutional rights.

You are entitled to:

- Be informed of the seizure and reason for it

- Present a defense through legal counsel

- Appeal the seizure or confiscation order

- Request a hearing if you believe the funds are unrelated to any crime

- Petition for the return of funds if not convicted

Even though the process is strict, the UAE courts strive to balance justice with fairness. Third parties who had no knowledge of the crime also have legal standing and protection under Article 26 of Decree-Law No. 20 of 2018.

The system recognises that innocent people may sometimes get caught in legal matters due to shared accounts, stolen identities, or indirect association.

Can the Police Keep Seized Money in the UAE?

This is a common question and a source of confusion. No, the police in the UAE cannot keep seized money for their own use or benefit. Any money taken during an investigation is held under judicial authority and is not allocated to law enforcement agencies.

Misconceptions vs. Legal Reality

In some jurisdictions globally, police departments may retain a portion of seized funds. That is not the case in the UAE. Here, law enforcement only has the power to freeze and safeguard assets. They do not benefit financially from seizures.

Confiscation is Strictly Controlled by Courts, Not Police Discretion

The UAE’s legal structure requires:

- A judicial ruling for permanent confiscation

- Oversight from the Public Prosecution

- Documentation of the money’s origin and use

Police are part of the investigation, but only courts can decide what happens to the money.

Comparison With Practices in Other Countries

In contrast, countries like the United States allow police departments to keep a share of forfeited money, which raises concerns about bias and abuse.

The UAE avoids this by mandating that all proceeds go to the state treasury and not to the agency involved in the arrest or investigation. This system reinforces fairness and transparency, reducing any conflict of interest during investigations.

How UAE Businesses Can Avoid Asset Seizure Risks?

Companies operating in the UAE must follow strict financial regulations to avoid any risk of asset seizure, especially in high-risk sectors like real estate, crypto, trading, and financial services.

To Stay Protected:

- Maintain accurate financial records

- Ensure strict KYC (Know Your Customer) and due diligence procedures

- Use licensed professionals to handle client funds

- Avoid engaging in unverified cash transactions

- Implement internal AML (Anti-Money Laundering) policies

- Conduct regular compliance audits and staff training

- Cooperate fully with financial regulators or court orders

Failing to comply can result in account freezes, trade license suspension, or legal action. Proactive compliance is the best defense for UAE businesses to stay legally safe and operational.

What Laws Govern Asset Seizure in the UAE?

The framework for asset seizure and confiscation in the UAE is built upon several powerful laws and regulatory systems.

Core Legal Instruments Include:

- Federal Decree-Law No. 20 of 2018: Focuses on anti-money laundering and defines confiscation, fines, and penalties.

- Cabinet Decision No. 10 of 2019: Details AML procedures, reporting, and compliance responsibilities.

- UAE Penal Code: Applies to criminal offences involving financial fraud, corruption, or embezzlement.

- Central Bank AML Rules: Provide banking institutions with clear compliance obligations, including STR filings through the goAML platform.

- Civil Procedure Law (CPL): Offers additional legal protection and mechanisms for enforcement and appeals.

Together, these laws aim to protect the integrity of the UAE’s economy while respecting individuals’ legal rights during seizures.

Conclusion

Money seized by police in the UAE is subject to a clear legal pathway, from investigation and temporary freezing to court-ordered confiscation or return. While the laws are strict, they are built to protect both national security and individual rights.

If you find yourself in such a situation, the best course of action is to understand your legal options, maintain proper documentation, and consult a qualified UAE legal professional.

Whether you’re an individual or a business, knowing the system helps you avoid costly mistakes and secure the right outcome.

FAQs

What is the first step taken when money is seized by police in the UAE?

Authorities immediately freeze or safeguard the funds pending investigation, often through bank holds or physical custody.

Do police need a warrant to seize money in the UAE?

Police need probable cause and typically act under the guidance or order of public prosecution or courts.

Can I get my money back if no charges are filed against me?

Yes, if you can prove legal ownership and no connection to criminal activity, you can request a return through court petition.

What happens if the money is tied to someone else’s crime but was in my possession?

You can claim an innocent owner defense by proving you had no knowledge or involvement in the criminal act.

How long does the UAE hold seized money before transferring it to the treasury?

If criminally linked, funds are held until conviction. Lost property without ownership claims goes to the treasury after one year.

Can companies have their bank accounts seized without a court case?

Yes, if linked to AML violations or suspicious activity, accounts can be frozen before court action is taken.

What should I do if I think my money was wrongfully seized?

Contact a legal professional immediately to file for restitution and begin the process of reclaiming your property.